In today’s data-driven financial world, banks are a prominent client sector where analytical reporting is in high demand. To better understand their needs, we look into the nature of the bank, its current condition, and its specific requirements.

Imagine a bank trying to improve its financial performance. To achieve this, it requires precise and insightful data that can only be obtained through analytical reporting.

The Bank’s Profile and Its Implications for Analytics

The bank’s profile is an essential factor in shaping its analytical solutions. In a universal commercial bank, for instance, all tools of analytics are indispensable. They’re needed for evaluating loan portfolios, branch network performance, managerial effectiveness, risk assessment, and regulatory compliance.

Consider a bank with a wide branch network. Analytical tools can provide insights into the performance of each branch, allowing for improvements where necessary.

Meanwhile, banks serving corporate clients require analytics to solve a range of tasks from standard analysis and control to modeling the impact of potential transactions on their assets and work margins.

The Role of Data Warehouses in Banking Analytics

In the banking sector, data warehouses are ubiquitous. The maturity of these data repositories varies across banks, as does their choice of data storage solution providers, but their presence is a clear indicator of the maturity of Data Governance in the bank.

Despite implementing DWH projects, banks often possess additional data sources, like Excel files or external services hosting open data. However, the data repository is pivotal for Qlik’s analytics, providing data for retail loan portfolio showcases, financial management reporting metrics, risk assessment, and revenue generation in different business areas.

Expanding Scope of Analytical Tasks

As our work with banks continues, the range of analytical tasks broadens. Banks are not only advancing their financial services but also building ecosystems. They seek to understand their revenue streams, extending beyond interest from loans and deposit portfolio management, to additional services, like insurance or various information.

In our experience in the banking sector, there has always been a significant person or a group of people – the project drivers – who’ve played a vital role in steering the project’s course. These individuals often hail from the financial department, determining the project direction, collaborating with IT to establish BI competence centers and enabling self-service functionalities for business users to interact independently with data.

These project drivers within banks are crucial. Their leadership can ensure a successful future for the project as they lay down the methodological foundation for all activities in the BI sphere. They also establish a common glossary of indicators for the bank, along with rules for working and interacting within the bank to create new analytical reporting.

The Importance of Security Structures

Another noteworthy observation is the involvement of security structures in almost every project. Their participation is critical for initial agreement on the information flows organized within the bank’s analytical system and subsequent analysis of system operation, user activities, access patterns, and system session details.

The expanding scope of analytical tasks, the pivotal role of project drivers, and the necessary involvement of security structures illustrate the complexity of banking analytics. With its robust functionalities and ability to adapt to diverse banking needs, Qlik Sense can support banks in navigating these complexities, developing ecosystems, and unlocking greater value from their data.

Analytics Implementation and Data Sources

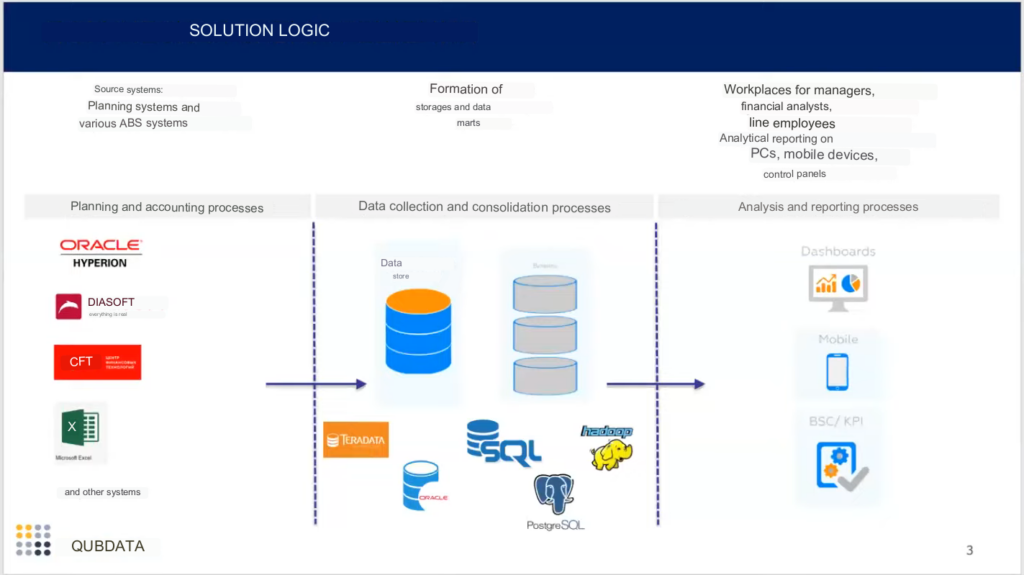

In implementing analytics in banks, we hardly ever interacted directly with operating systems due to security constraints. Rather, our work primarily revolved around data repositories, ensuring minimal load on the banking operating systems. These repositories, organized based on different solutions within the bank, served as the foundation for our analytics.

Simplified, the architecture usually encompasses a variety of data sources, including ABS or scheduling systems and file sources, underpinned by data warehouses.

It’s within these warehouses that analytics is developed to cater to various user categories.

Meeting the Needs of Mobile Users

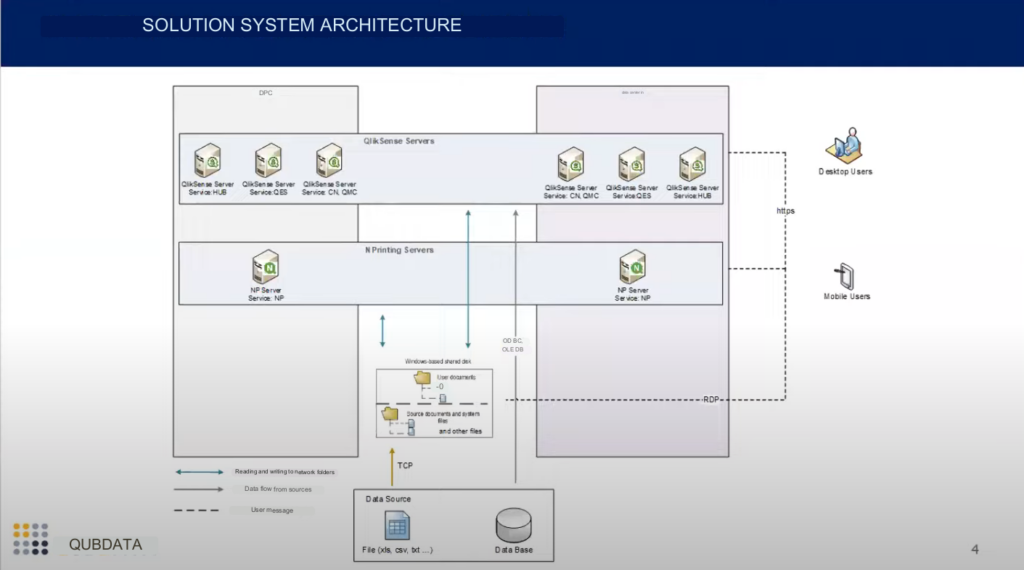

Top managers, as primary consumers of these analytics, often require access via mobile devices. As such, the architectures we’ve developed in partnership with security departments integrate with Mobile Device Management (MDM) class systems. This ensures that users, even when outside of the bank’s Wi-Fi network, can securely connect to sensitive data, including banking or trade secrets and personal user data.

Prioritizing Fault Tolerance and Data Duplication

In the banking sector, whether commercial or state-owned, there’s significant focus on fault tolerance. As such, all solutions deployed for banks involve the use of distributed installation and duplication of components. This ensures robustness and continuity even in the event of a fault.

There was some initial skepticism, dating back to about 10-15 years ago, regarding Qlik’s capacity to manage large volumes of data. Some banks conducted tests to dispel these doubts, further cementing Qlik’s position as a dependable solution for banking analytics.

Custom Analytics for Detailed Reporting

One project we undertook was for a Treasury Department client, who required analytics for detailed balance sheet reporting, encompassing all their business types – corporate, small and medium-sized, retail, and so forth. They sought the ability to drill down into each line item of the balance sheet for the most granular view.

For this, we integrated with Oracle, receiving and loading data into Qlik daily. This allowed users to appreciate how Qlik could efficiently process hundreds of millions of records – about 300 million in this case – all with impeccable performance. As the bank transitioned from initial skepticism to recognizing how well the solution served both their business and technological needs, the system was prepared for commercial operation.

Ensuring High System Availability

At this point, the system’s organization over two or three servers comes into play. Each data center has a mirrored configuration, ensuring high system availability to business units even in the event of a server failure. This setup demands some investment and effort, but for a bank where Business Intelligence is critical, this is a non-negotiable deployment scenario.

Variety of Tasks in the Banking Sector

Reflecting on our experience, we’ve tackled an assortment of tasks with our clients in the banking sector. In some cases, a bank comprehensively views its business from a top-down perspective, understanding the importance of tracking strategic performance indicators. This scrutiny then cascades to business direction level, involves detailed product analysis, and permeates the entire scope of retail analytics.

However, only a handful of banks, around 2-3, have approached all of their analytics reporting in this holistic manner. Some banks choose to focus on specific pain points relevant to their business operations.

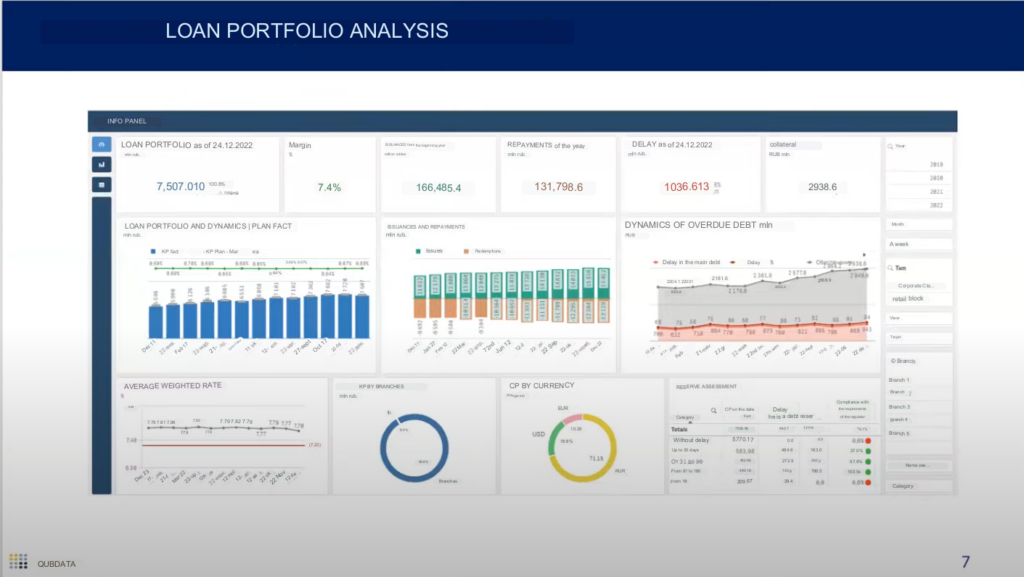

Loan Portfolio Analysis

For instance, one common area of focus is loan portfolio analysis. Here, the approach varies based on whether we’re looking at the corporate sector or retail. In the retail sector, the bank monitors changes in the structure of its mortgage, consumer loan, and credit card portfolios. This analysis further cascades down to individual products, assessing the weighted average rate and associated risks.

If the bank also has information about all the loan applications it’s considering, we can conduct a full cycle analysis, visualizing the credit pipeline that the bank manages to provide lending in the retail sector. This visualization covers different products, catering to varying customer needs.

KPI and Departmental Evaluations in Corporate Analytics

Analyzing the corporate sector requires a different approach. It’s not just about assessing the structure of the loan portfolio; it also involves evaluating risk-weighted assets. This is crucial since corporate clients typically consume capital in larger volumes compared to retail clients. In addition, it’s necessary to assess the margin at the loan portfolio level, factoring in all potential risks, costs, provisions, and more.

When a bank chooses a comprehensive approach to analytics, the strategy takes center stage. Key performance indicators are tracked over a 3-5 year horizon. From there, the focus narrows to individual areas. The head of each area evaluates their department’s performance, sets goals, and monitors the implementation of plans.

Product analysis is indispensable. Understanding the structure of the product portfolio, whether it includes deposits, loans, or other services, is fundamental. Back office analytics are also crucial as they allow the bank to control general expenses, manage human resources, and oversee other administrative functions.

Customer Analytics and Loan Portfolio Analysis

Customer analytics extends beyond just building client profiles or analytics by client groups. It often integrates into banking portals developed with specialized tools like Microsoft products or WebSphere. It serves dual functions: a tool for internal client management and a service for customers accessing their personal account on the portal.

Analysis of the loan portfolio varies based on the target audience. Some banks focus on retail block analysts, while others target corporate finance analysts. One bank required a “what-if” analysis to examine the impact of a potential deal on their loan portfolio structure. This involved modeling the deal volume and calculating the necessary reserves, considering the client quality and associated risks.

Crucial elements of loan portfolio analysis include monitoring the dynamics and evaluation of margins, understanding loan portfolio formation, and analyzing debt issues. Additional assessments include loan portfolio collateralization and reserve status to measure coverage for potential losses.

Motivational Reporting and Management Reporting

Motivational reporting, prevalent in many banks, swiftly informs managers about their performance against plans and potential rewards at the reporting period’s end. It covers a range of indicators, focusing not only on sales but also on profitability, margins, and customer satisfaction plans.

Management reporting, implemented in several banks, involves numerous indicators requiring analysis. Depending on the user’s level of detail and frequency, it could be a concise summary for top management or an in-depth, transaction-level analysis for middle management.

Determining the information blocks for analysis and aligning them with the bank’s business cross-section is vital. This could involve market evaluation, portfolio evaluation, assessment of individual financial responsibility centers, and more.

Benefits of Using Qlik Sense in the Banking Sector

In conclusion, organizations using Qlik Sense have invariably achieved significant benefits, including reducing reporting burdens. Some financial departments have cut the time it takes to close the reporting period by up to 7-10 times. Customers have praised the tool’s ability to expand the information field, enabling deep data analysis, yielding valuable insights and understanding trends in their businesses.

The adoption of advanced analytics and Business Intelligence (BI) tools such as Qlik Sense is becoming increasingly important in the banking sector. This article explored several dimensions of implementing such systems in banks and provided real-world examples of their impact.

Key takeaways from the article include:

- Digitization and Data Analytics: Banks are embracing digitization and data analytics tools to streamline their operations, gain insights, and make data-driven decisions. Analytics can provide valuable insights into various banking aspects, from strategic planning to detailed product analysis and back-office operations.

- Tools like Qlik Sense: Tools like Qlik Sense provide robust, comprehensive solutions that can handle vast amounts of data, offering interactive dashboards and easy-to-understand visualizations. They also enable the integration of data from various sources, including ABS systems and scheduling systems, while ensuring minimal load on these systems.

- Client and Loan Portfolio Analysis: Customer analytics in banking extends beyond building client profiles, providing tools for internal management and serving as a service for customers accessing their personal accounts. Loan portfolio analysis, depending on the target audience, can help banks understand the structure of their portfolio, assess risks, and make informed decisions.

- Management and Motivational Reporting: Motivational and management reporting systems provide swift feedback to managers about their performance, potential rewards, and detailed business analysis. Such reporting systems can offer a wide range of indicators, focusing not only on sales but also on profitability, margins, and customer satisfaction.

- Security and Fault Tolerance: Security is a paramount concern in banking. Solutions implemented need to ensure secure data access, even from mobile devices, through integration with Mobile Device Management (MDM) class systems. The implemented systems should also be fault-tolerant, using distributed installation and component duplication to ensure high availability.

- Impact of Qlik Sense: Implementing Qlik Sense has led to considerable benefits, such as reducing reporting burdens and expanding the information field. Financial departments have reportedly cut down reporting times significantly, enabling a more in-depth analysis that yields valuable insights.

In conclusion, the integration of advanced BI tools such as Qlik Sense in the banking sector is not just a trend but a necessity for modern banks aiming to leverage their data for strategic decision-making and efficient operations. These tools can provide extensive benefits, improving various areas of banking operations, from strategy and client management to portfolio analysis and reporting.