Financial services firms are using their data to gain a competitive edge, manage risk, and build stronger customer relationships. Our analytics solutions provide a 360-degree view of customers, portfolios, and products, enabling better decision-making for all stakeholders.

We help automate data cleansing, integration, and reporting from all sources, analyze risk factors, use customer data to build profiles for targeted marketing, manage investments and portfolio performance, identify underperforming locations, and ensure compliance.

A business intelligence (BI) system and the creation of a data warehouse can help a company in the financial sector in several ways:

Improved decision-making

By integrating data from different sources into a single data warehouse, a BI system provides decision-makers with a comprehensive and accurate view of their business operations. This allows them to make informed decisions based on data-driven insights, rather than gut feelings or incomplete information.

Risk management

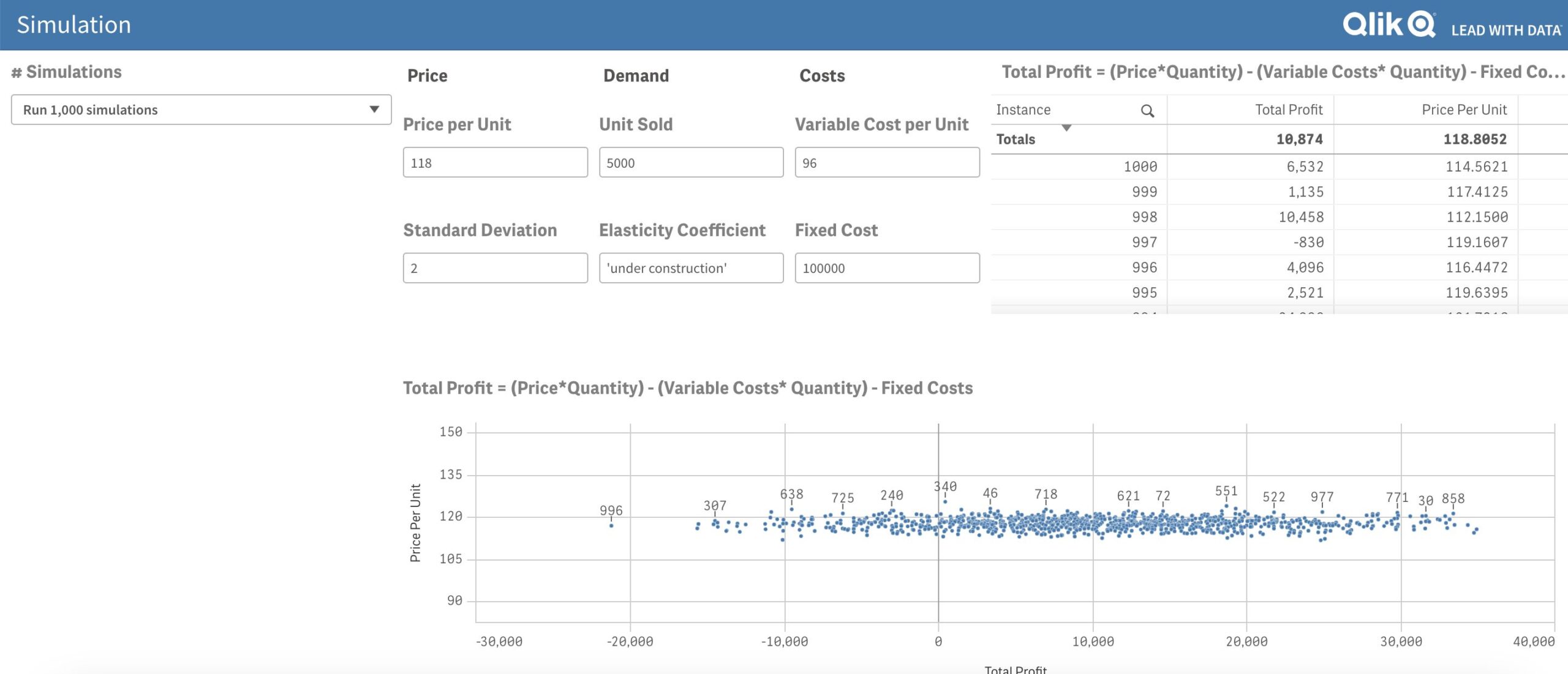

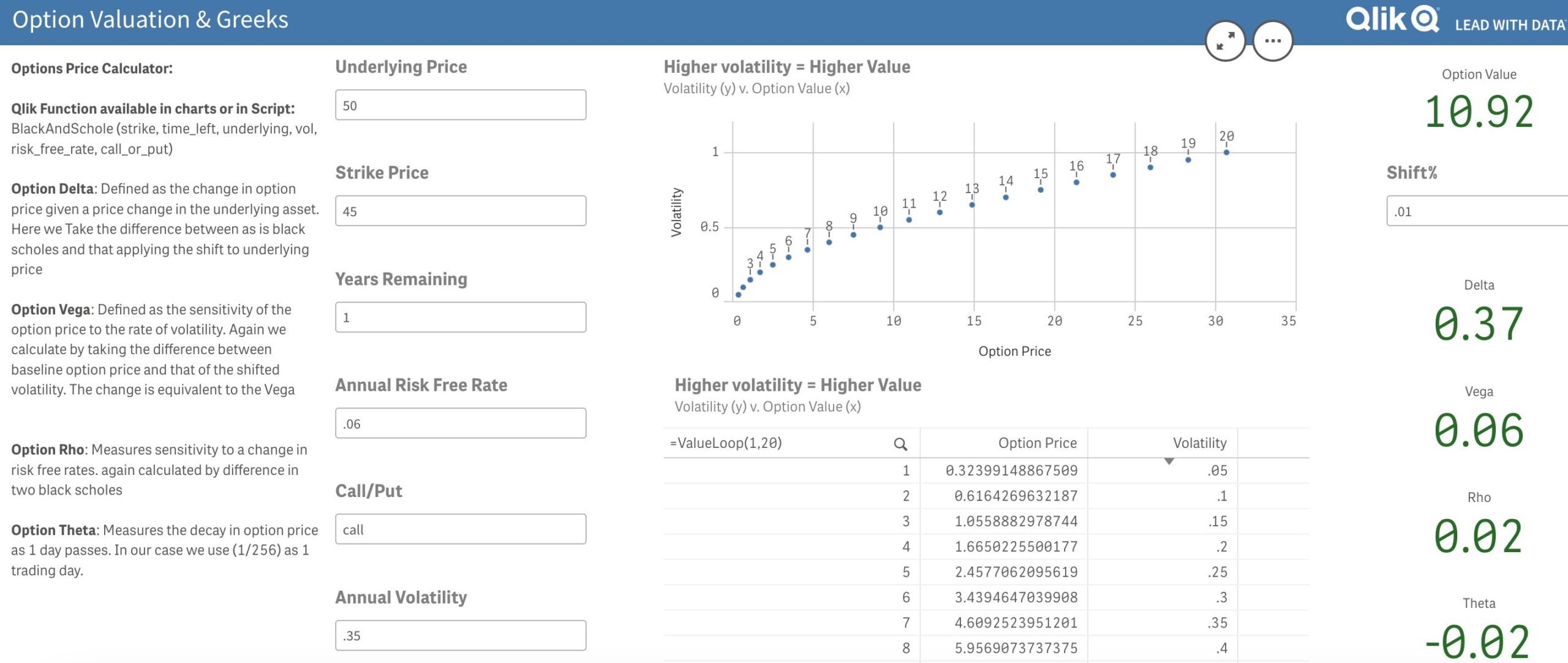

BI systems can help financial institutions identify and mitigate risks by analyzing data from various sources, such as transaction records, customer behavior, and market trends. This can help institutions to manage credit risk, fraud risk, market risk, and operational risk more effectively.

Cost reduction

BI systems can help companies in the financial sector reduce costs by identifying inefficiencies and opportunities to streamline operations. By analyzing data on things like process times, resource usage, and customer behavior, companies can identify areas for improvement and reduce unnecessary expenses.

Customer insights

BI systems can provide companies with valuable insights into customer behavior and preferences. By analyzing customer data, companies can better understand their customers, develop targeted marketing campaigns, and improve customer satisfaction.

Regulatory compliance

With increasing regulatory requirements in the financial sector, BI systems can help companies ensure compliance by tracking and analyzing data related to regulatory requirements, such as anti-money laundering regulations or Know Your Customer (KYC) policies.

Overall, a BI system and data warehouse can provide a company in the financial sector with a competitive advantage by providing a centralized view of data, enabling better decision-making, and improving operational efficiency.

Here are some examples of how a bank can use business intelligence (BI) to gain insights and make better decisions:

Customer Analytics

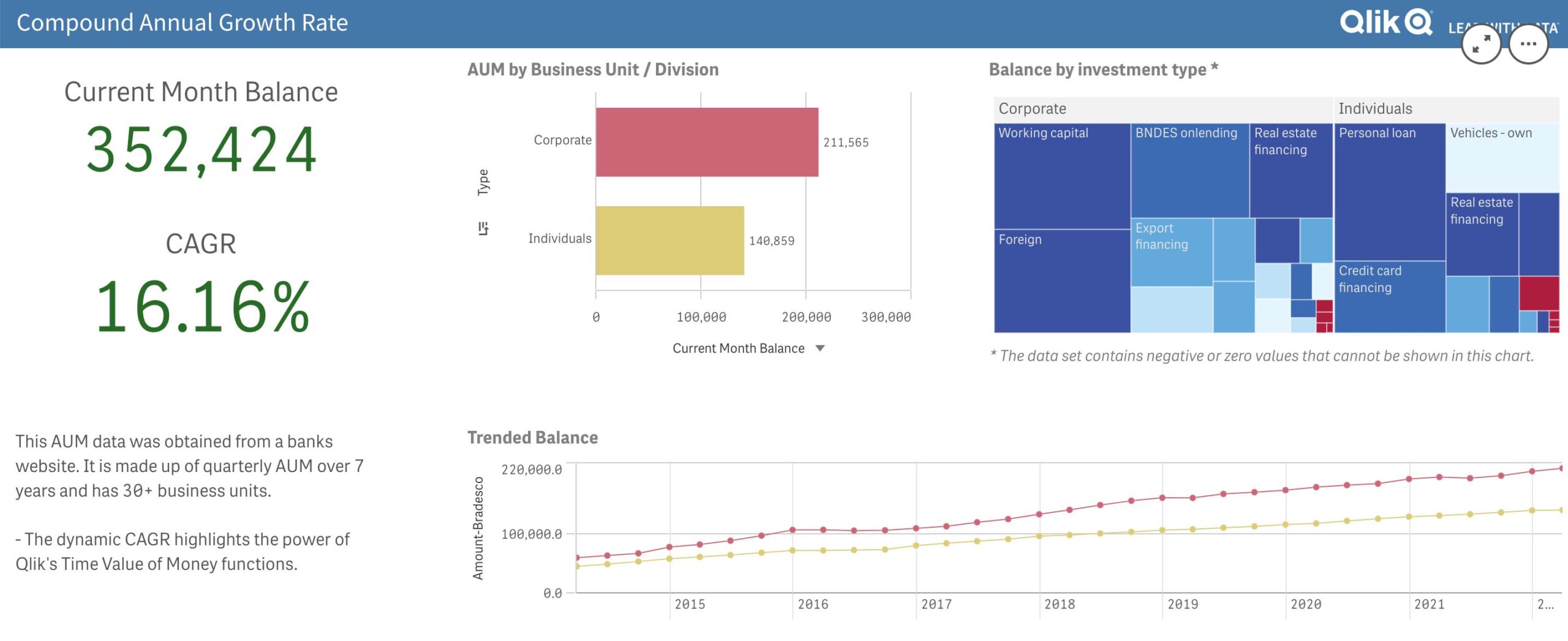

A bank can use BI to analyze customer data such as demographics, transaction history, credit score, and behavior patterns. This can help the bank understand its customers better, predict their needs, and offer personalized services to improve customer satisfaction and retention.

Fraud Detection

BI can be used to monitor transactions and detect fraudulent activities. By analyzing patterns and trends, the bank can identify suspicious transactions and take appropriate actions to prevent fraud.

Risk Management

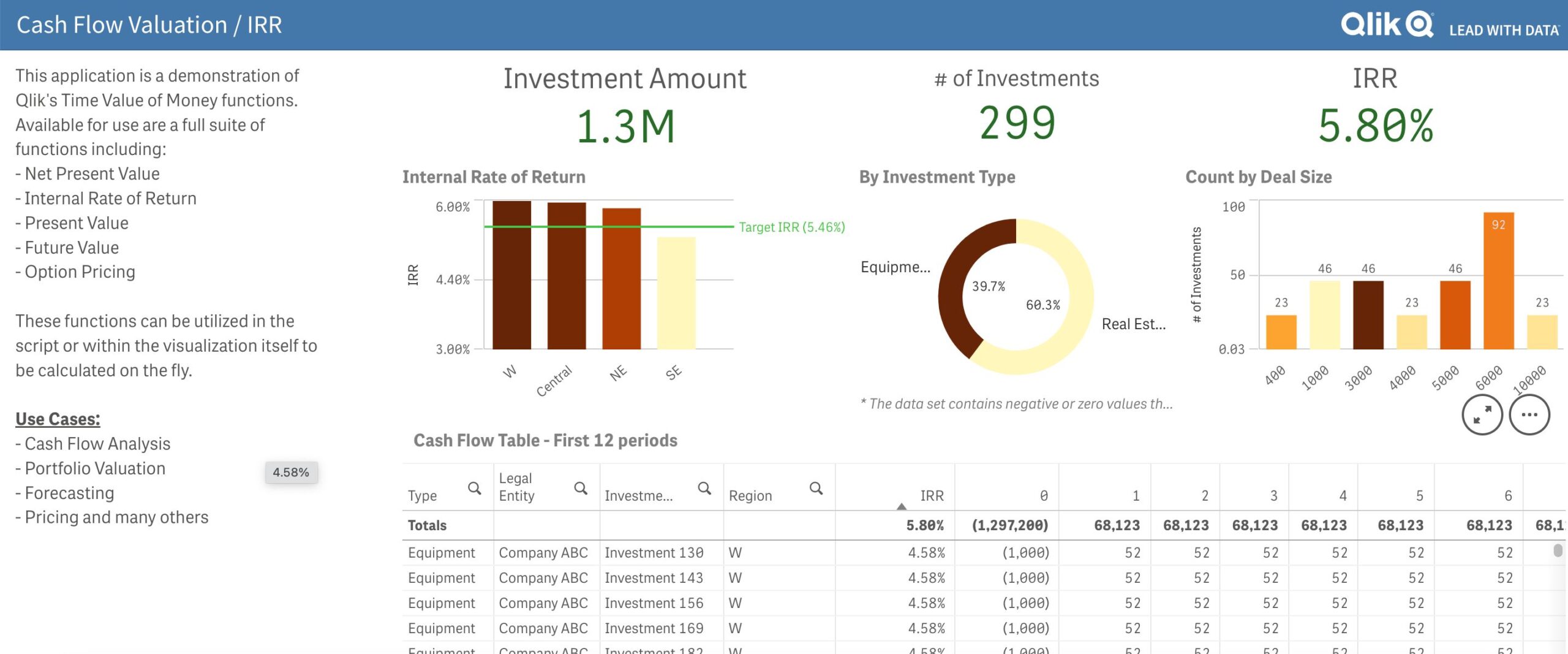

Banks can use BI to analyze data from various sources such as financial markets, credit ratings, and economic indicators to assess risk exposure. This can help them make better decisions on risk mitigation strategies and comply with regulatory requirements.

Marketing and Sales

BI can be used to analyze customer data and identify trends, patterns, and preferences. This can help the bank develop targeted marketing campaigns and create personalized offers for different customer segments.

Performance Management

BI can provide real-time data on key performance indicators (KPIs) such as profitability, cost, and revenue. This can help the bank monitor its performance, identify areas for improvement, and optimize its operations.