We assist insurance companies in leveraging data to deliver superior customer service while expertly handling industry obstacles stemming from strict regulations and intense competition.

Insurance Data and Analytics Services

Our comprehensive data and analytics solutions enable insurers to develop a better understanding of customers, boost retention, refine underwriting risk assessments, decrease claims costs, and discover new sources of growth.

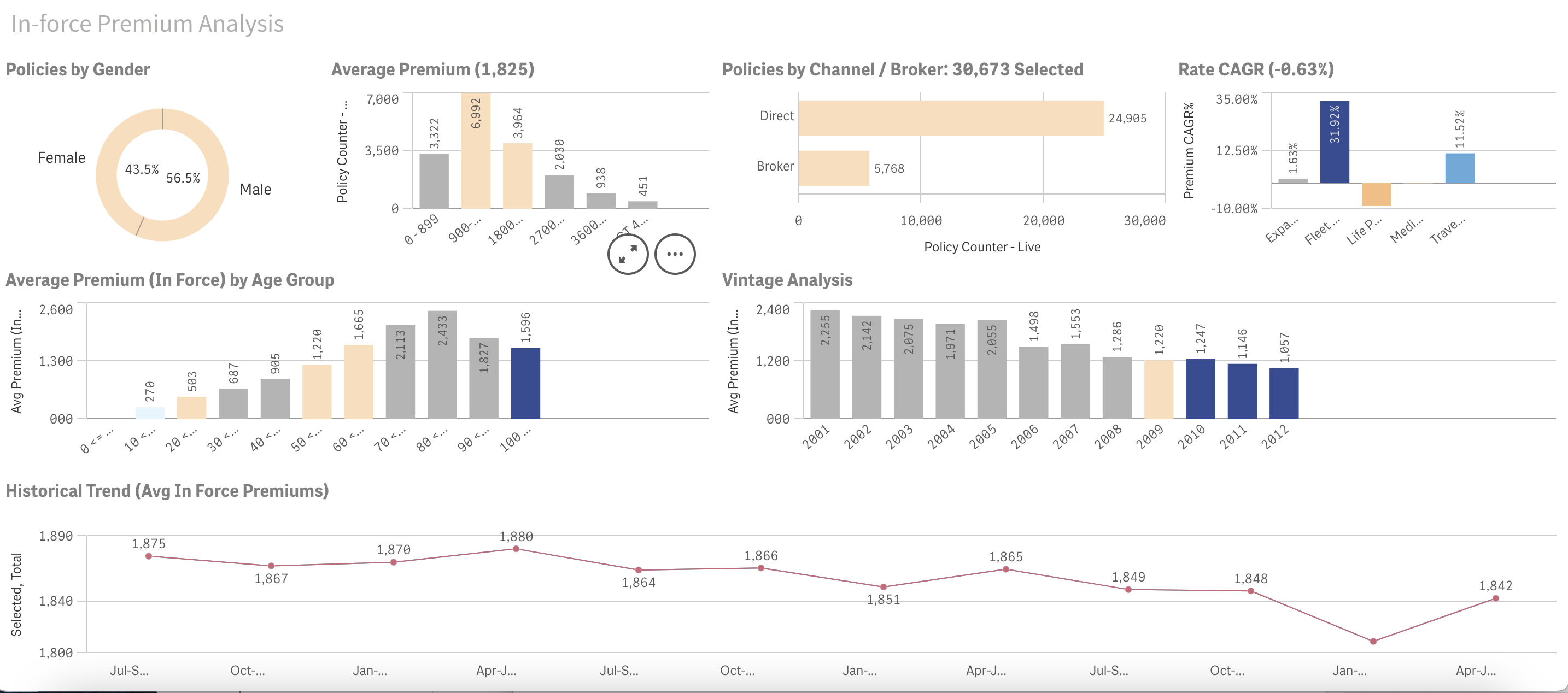

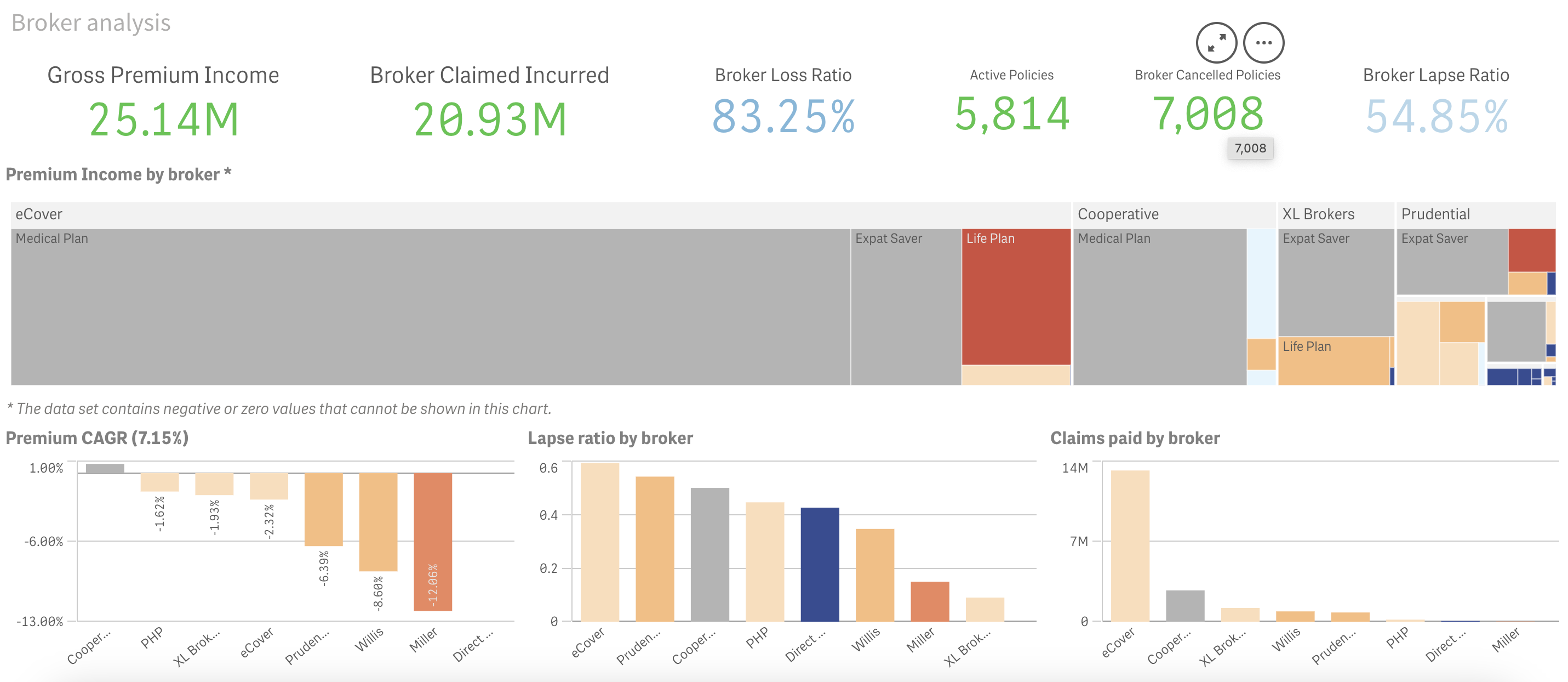

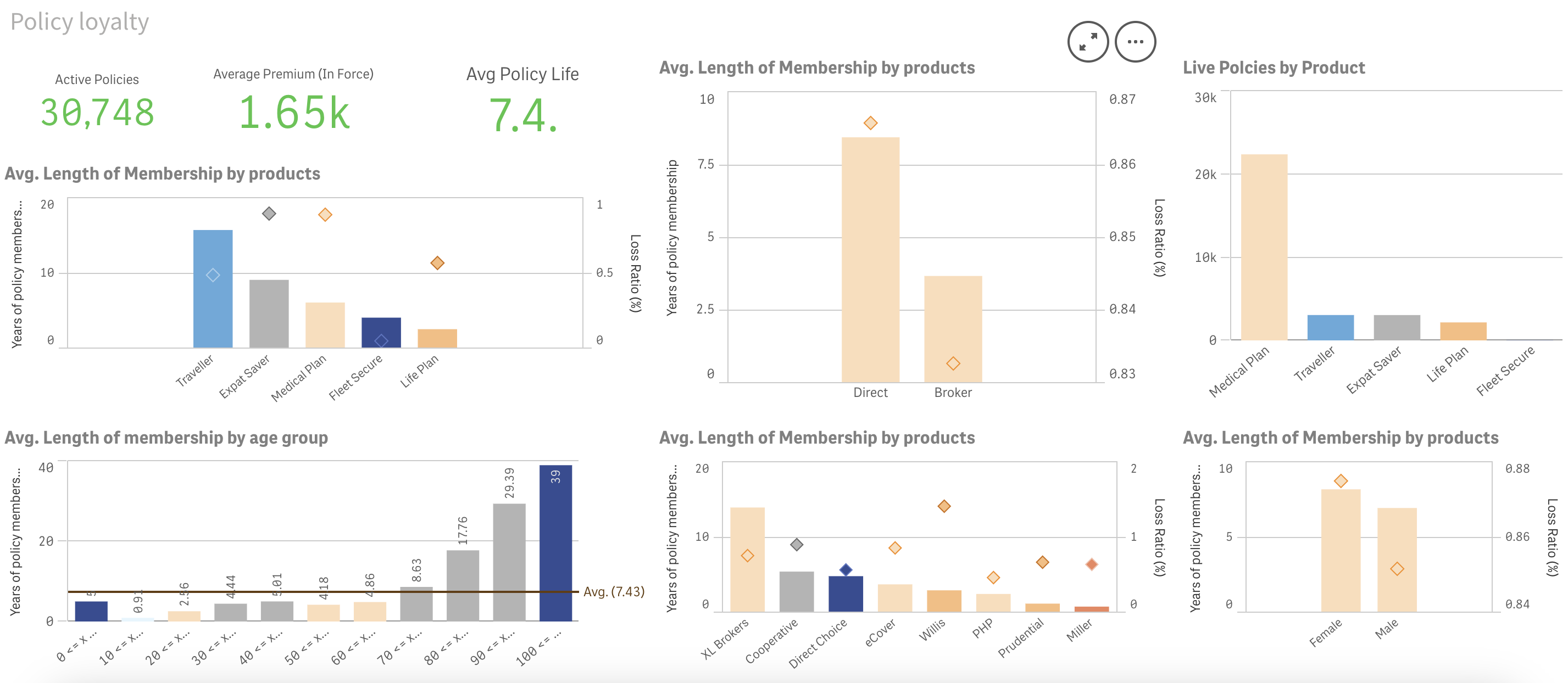

We work with you to unify data from all insurance sources, including sales (CRM), claims, and policy (underwriting), to provide a complete 360-degree view of your customers. We know a standard analytics solution won’t meet your needs, which is why we construct tailored insurance dashboards that allow for intuitive analysis of key performance indicators (KPIs) such as rate, retention, earned, premium, combined ratio, and loss ratio.

Risk Evaluation

Examine historical claims data to recognize patterns that help determine the level of risk presented by applicants and establish pricing in accordance with the risk.

Fraud Detection

Easily identify red flags during the application process and automate the process so that agents can decide on the appropriate policy issuance course of action. Identify trends over time and proactively avoid fraudulent claims.

Custom Policy Development and Enhanced Customer Experience

Using data analytics methods such as customer segmentation, we assist you in gaining a more thorough and nuanced understanding of customer behaviors and preferences to create personalized policies.

Claims Advancement

Integrate claims and policy data to evaluate profitability. Extract significant information from adjuster claim notes. Create optimized claim adjuster staffing models based on historical data and claim volume predictions.

Here are a few examples of how an insurance company can use business intelligence (BI):

Risk assessment

Analyze historical claims data to identify trends that help determine the risk applicants represent, and develop pricing in accordance with the risk.

Fraud detection

Easily identify and automate red flags during the application process so agents can determine the course of action on policy issuance. Uncover trends over time and proactively avoid fraudulent claims.

Customer segmentation

Use analytics techniques like customer segmentation to gain a more granular and nuanced understanding of customer preferences and behaviors to create personalized policies.

Claims modernization

Marry claims and policy data to measure profitability. Mine claim notes for important and relevant information from adjusters. Optimize claim adjuster staffing models based on historical data and claim volume projections.

360-degree view of customers

Tie together insurance data from all sources (sales, claims, and policy) to get a comprehensive view of customers. Use this data to gain insights into KPIs such as loss ratio, combined ratio, rate, retention, earned, and premium.